State of U.S. Consumer and Small Business Deposit Trends

Halfway through 2025 and consumer deposits are on the rise, while small business deposits continue to face pressure against higher federal funds rates. Federal Reserve policies will continue to play a key role in influencing these trends throughout the rest of 2025, impacting strategies across the financial landscape.

ProSight’s latest insights, gathered from the top 20 U.S. consumer and leading direct banks, highlight critical deposit market shifts.

Check out these highlights from the�June 2025 State of U.S. Deposit Market webinar.

Prevailing Banking Trends

Key Consumer Deposit Trends

Key Small Business Deposit Trends

View Webinar

Interest rate impacts:�Anticipated rate reductions haven’t materialized, causing disruptions across banking.

Top challenges

Deposit growth

Customer acquisition

Operational efficiency

Key opportunity

Enhancing technology integration and customer-centric digital experiences are ways to attract new customers and support deposit balance growth.

Cash incentives on the rise with mixed results

Deposit growth projections

Federal Funds (end of 2025)

Generational shifts

Digital impact

Signs of recovery

Federal Funds (end of 2025)

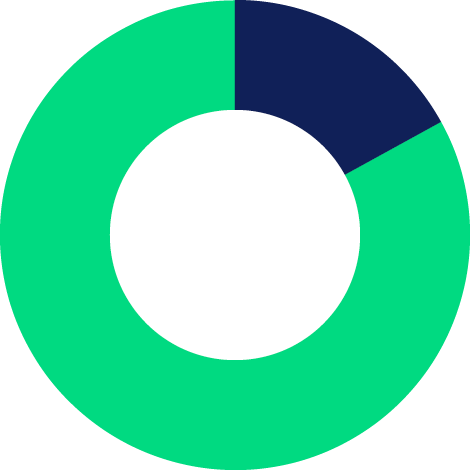

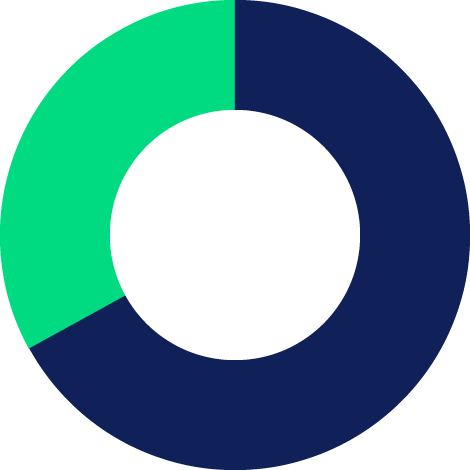

Consumer deposits expected to grow between 2% and 3% in 2025 if federal funds rates drop further.

Savings and MMDA accounts show steady performance because of slowing CD renewals.

17%

of new checking accounts are tied to cash incentives.

Checking balances are improving from -5.8% in 2024 to -1% YTD in 2025.

gen z

16%

millennials

39%

Gen Z (16%) and millennials (39%) dominate new account openings, favoring digital channels.

Digital accounts with cash offers outperform branch-incentivized accounts by 2.5x, driven by Millennials and Gen Z who value convenience, speed and the ease of digital interactions

of offers are $300+, but promo accounts average lower balances ($2,500 vs. $4,100).

67%

of promotions are now delivered online.

Nearly 50%

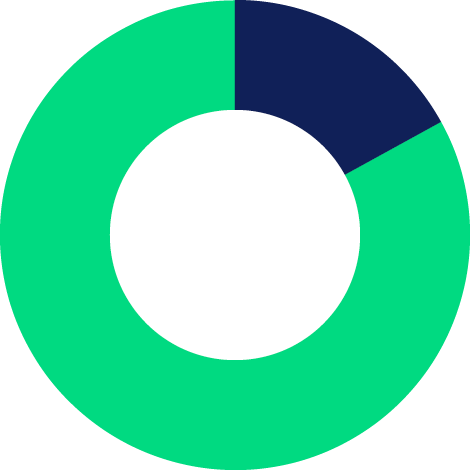

Consumer Deposit Balance Growth:

1% to 2%

Hold rates

3.75% to 4.00%

3.00% to 3.35%

Deposits are up 0.4% YTD (2025), rebounding from -0.3% in 2024.

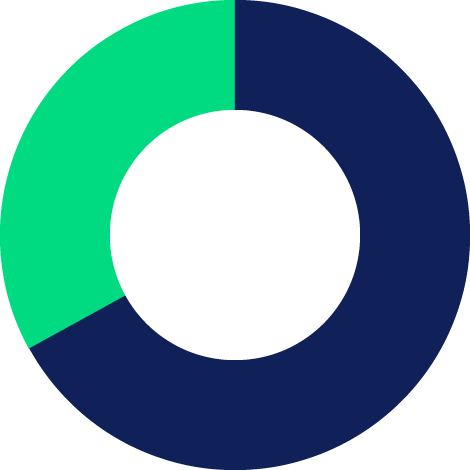

Interest rate impacts:�Historical data shows federal funds rates exceeding 2% hinder small business deposit growth, as businesses prioritize cash for operations rather than savings.

With anticipated rate cuts, year-end projections suggest declines may stabilize to -1% to -2%.

Discover more about these crucial trends shaping the financial industry and adapt your strategy today.

Register for our 2025 State of U.S. Deposits Quarterly webinar series.

Register Now

Deposits

checking balances

Deposit growth:

�Federal funds rates > 2% lead to deposit declines

Customer acquisition:

�Increased competition for fewer new customers

Operational efficiency:

�Optimizing workflows is crucial amidst economic uncertainty and high interest rates

of offers are $300+, but promo accounts average lower balances ($2,500 vs. $4,100).

67%

of new checking accounts are tied to cash incentives.

17%

Checking balances grew +0.2% YTD, MMDAs +1.9%, CDs +6.1%.

3.75% to 4.00%

Hold rates

3.00% to 3.35%

2% to 3%

Consumer Deposit Balance Growth:

3% to 4%

Consumer Deposit Balance Growth:

-3% to -4%

Small Business Deposit Balance Growth:

3.00% to 3.35%

3.75% to 4.00%

Hold rates

3.00% to 3.35%

3.75% to 4.00%

Hold rates

-11% to -2%

Small Business Deposit Balance Growth:

0% to +1%

Small Business Deposit Balance Growth:

Deposit growth projections

Deposits